16th June 2020 , 2 min read

Gunnar Uldall's Tax Tariff

This site is kindly hosted by lima-city . Original post is here eklausmeier.goip.de/blog/2020/06-16-gunnar-uldalls-tax-tariff .

Gunnar Uldall wrote a a book with title "Die Steuerwende " in 1996.

1. Proposal. In this book he proposed the following tariff, $x$ is in DEM .

$$

t_u(x) = \begin{cases}

0 & \mbox{if } x\le12000 \\

0.08\left(x-12000\right) & \mbox{if } 12001\le x\le20000 \\

0.18\left(x-20000\right)+640 & \mbox{if } 20001\le x\le30000 \\

0.28\left(x-30000\right)+2440 & \mbox{if } x\ge30001

\end{cases}

$$

Of course, Gunnar Uldall opposed to add any solidary extra tax. Unfortunately, his proposal did not make it into law, although his proposal was well received in the public.

Gunnar Uldall makes a short historic reference to von Miquel 's tariff. The tariff from 1891 with $x$ is in Goldmark is given below.

$$

t_m(x) = \begin{cases}

0 & \mbox{if } x\leq900 \\

6 & \mbox{if } 900\lt x\leq1050 \\

9 & \mbox{if } 1050\lt x\leq1200 \\

12 & \mbox{if } 1200\lt x\leq1350 \\

16 & \mbox{if } 1350\lt x\leq1500 \\

21 & \mbox{if } 1500\lt x\leq1650 \\

26 & \mbox{if } 1650\lt x\leq1800 \\

31 & \mbox{if } 1800\lt x\leq2100 \\

36 & \mbox{if } 2100\lt x\leq2400 \\

44 & \mbox{if } 2400\lt x\leq2700 \\

52 & \mbox{if } 2700\lt x\leq3000 \\

60 & \mbox{if } 3000\lt x\leq3300 \\

70 & \mbox{if } 3300\lt x\leq3600 \\

80 & \mbox{if } 3600\lt x\leq3900 \\

92 & \mbox{if } 3900\lt x\leq4200 \\

104 & \mbox{if } 4200\lt x\leq4500 \\

118 & \mbox{if } 4500\lt x\leq5000 \\

132 & \mbox{if } 5000\lt x\leq5500 \\

146 & \mbox{if } 5500\lt x\leq6000 \\

160 & \mbox{if } 6000\lt x\leq6500 \\

176 & \mbox{if } 6500\lt x\leq7000 \\

192 & \mbox{if } 7000\lt x\leq7500 \\

212 & \mbox{if } 7500\lt x\leq8000 \\

232 & \mbox{if } 8000\lt x\leq8500 \\

252 & \mbox{if } 8500\lt x\leq9000 \\

276 & \mbox{if } 9000\lt x\leq9500 \\

30\lfloor (x-10500)/1000\rfloor + 330 & \mbox{if } 9500\lt x\leq30500 \\

80\lfloor (x-32000)/1500\rfloor + 1040 & \mbox{if } 30500\lt x\leq32000 \\

80\lfloor (x-32000)/2000\rfloor + 1040 & \mbox{if } 32000\lt x\leq78000 \\

100\lfloor (x-78000)/2000\rfloor + 2900 & \mbox{if } 78000\lt x\leq100000 \\

0.04\lfloor x/5000\rfloor\cdot5000 & \mbox{if } x\gt 100000 \\

\end{cases}

$$

By design this tariff has discontinuities. The first fixed values cannot easily be fitted with a linear, quadratic or cubic polynomial.

As can be seen by this tariff, it starts with a rate of less than one promille. Then slowly increases to at most four percent.

2. Current situation. The current tax tariff for $x$ in EUR as of 2020 is

$$

t_c(x) = \begin{cases}

0 & \mbox{if } x\le 9408 \\

\left(972.87{\lfloor x\rfloor-9408\over10000} + 1400\right){\lfloor x\rfloor-9408\over10000} & \mbox{if } 9409\le x\le 14532 \\

\left(212.02{\lfloor x\rfloor-14532\over10000} + 2397\right){\lfloor x\rfloor-14532\over10000} + 972.79 & \mbox{if } 14533\le x\le 57051 \\

0.42\lfloor x\rfloor - 8963.74 & \mbox{if } 57052\le x\le270500 \\

0.45\lfloor x\rfloor - 17078.74 & \mbox{if } x\ge270501

\end{cases}

$$

Final tariff is then

$$

\mbox{Taxes} = \lfloor t_c(x)\rfloor

$$

Add to this 5.5% solidarity extra tariff.

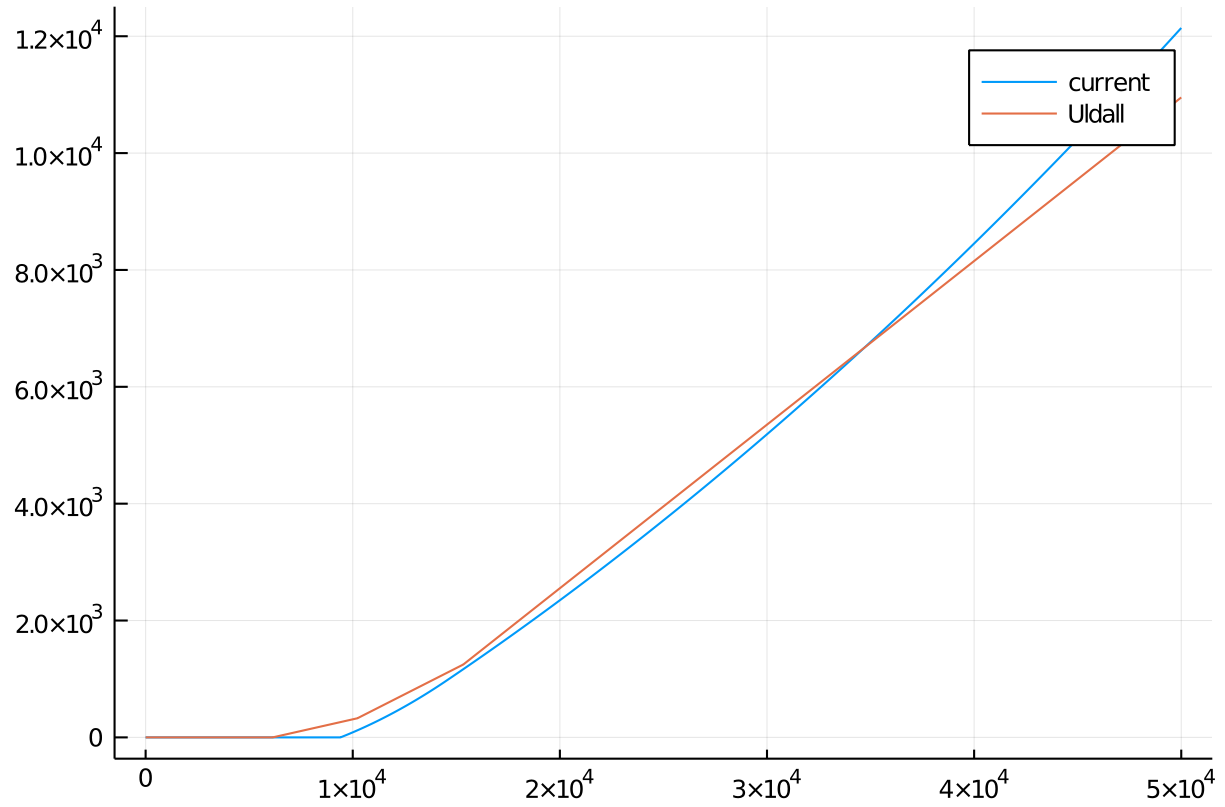

Graphical comparison of the two tariffs. First for amounts up to 50 kEUR.

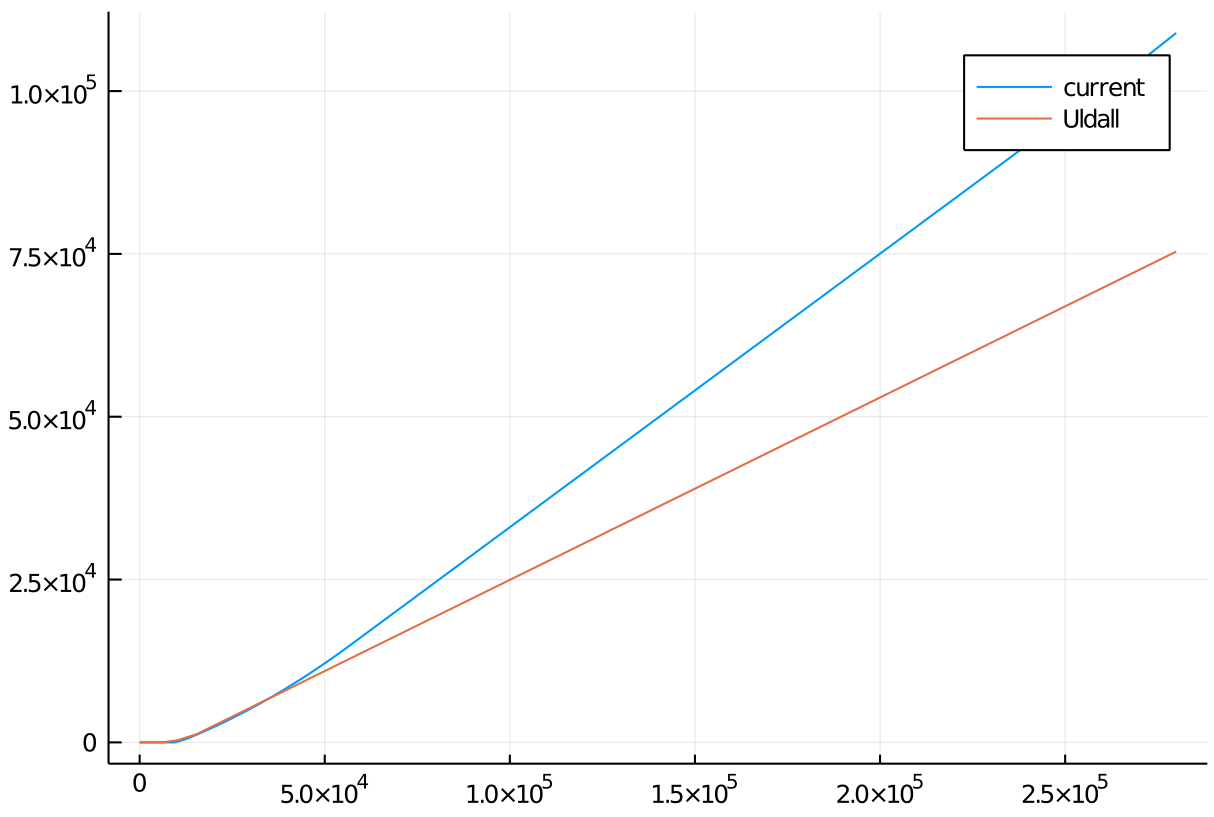

Now up to 280 kEUR.

Julia code is tariff.jl .